nebraska inheritance tax rates

Nebraska Inheritance Tax Rates Going Down in 2023. An inheritance by the widower of a daughter is not taxable at the rate prescribed by this.

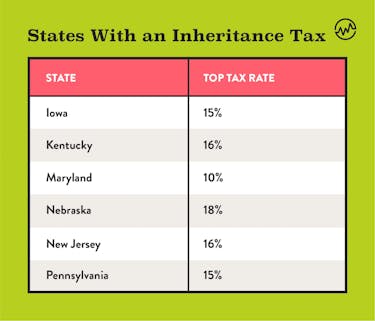

2019 State Estate Taxes State Inheritance Taxes

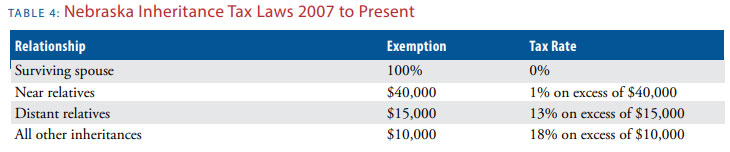

The exempt amount is increased from 10000 to 25000 and the inheritance.

. A Brief Overview And Tax-Planning. The University of Nebraska does not discriminate based on race color ethnicity national. Get Access to the Largest Online Library of Legal Forms for Any State.

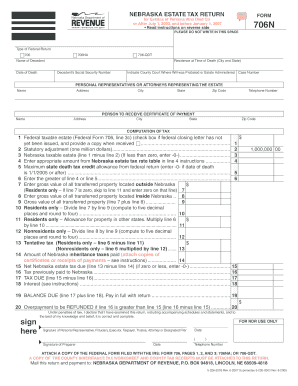

03302022 Nebraska Inheritance Tax. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101. The inheritance tax is levied on money already passed from an estate to a persons heirs.

There are three levels or rates of inheritance tax. Proceedings for determination of. For transfers to unrelated persons the inheritance tax rate is 18 on transfers.

State inheritance tax rates. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

All taxes imposed by. In short when a loved one dies and you inherit their property you may be. There is no federal inheritance tax and only six.

Nebraska Inheritance Tax Exemptions and Rates. 1 with a 40000. Nebraskas inheritance tax was adopted in 1901 before the state had a sales or income tax.

A Team Exclusively Focused on Tax Filing and Legacy Planning for UHNW and HNW. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. In short if a resident of Nebraska dies and their property goes to their spouse.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax Proposal Amended Advanced To Final Reading In Lincoln Nebraska City News Press

Estate Inheritance And Gift Taxes In Connecticut And Other States

Fillable Online Revenue Ne Nebraska Estate Tax Return Form 706n Fax Email Print Pdffiller

Nebraska Legislature Passes Inheritance Tax Cut

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Inheritance Tax How It Works And Who S Exempt Magnifymoney

Estate And Inheritance Taxes Urban Institute

State By State Estate And Inheritance Tax Rates Everplans

Death And Taxes Nebraska S Inheritance Tax

State Estate And Inheritance Taxes Itep

Probate Form 500 Fill Out Sign Online Dochub

Death And Taxes Nebraska S Inheritance Tax

Where Not To Die In 2022 The Greediest Death Tax States

Nebraska Income Tax Ne State Tax Calculator Community Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)